Investment Insights: Drawing Inferences from Market Cap Fluctuations.

There are multiple conclusions that can be drawn from analyzing the USDT, USDC and DAI marketcap chart. Cryptocurrency market insights can be drawn from this analysis. These insights, coupled with insights obtained from other indicators, data points or market briefings can help us attain a macro image of what is really going on in the cryptocurrency world.

What insights can be drawn from the USDT, USDC and DAI Marketcap chart? Let’s take a look down below.

It should be noted that DAI is backed by many collateralized assets via MakerDAO. USDC and USDT are some of the collateralized assets that back up DAI’s value.

Thus, using this chart does have its limitations because it assumes that all USDC and USDC are circulating, when instead they can be used to create and back DAI stable coins.

Liquidity Movement Analysis

Since these 3 are some of the biggest stable coins in the cryptocurrency market, liquidity moves from one stablecoin to another. Liquidity from the outside, traditional finance world also moves into preferred stablecoins over other stablecoins. People often swap between stablecoins too. For example, in centralized exchanges, people may swap between USDT, USDC, DAI and Bitcoin or Ethereum to get in and out of the markets.

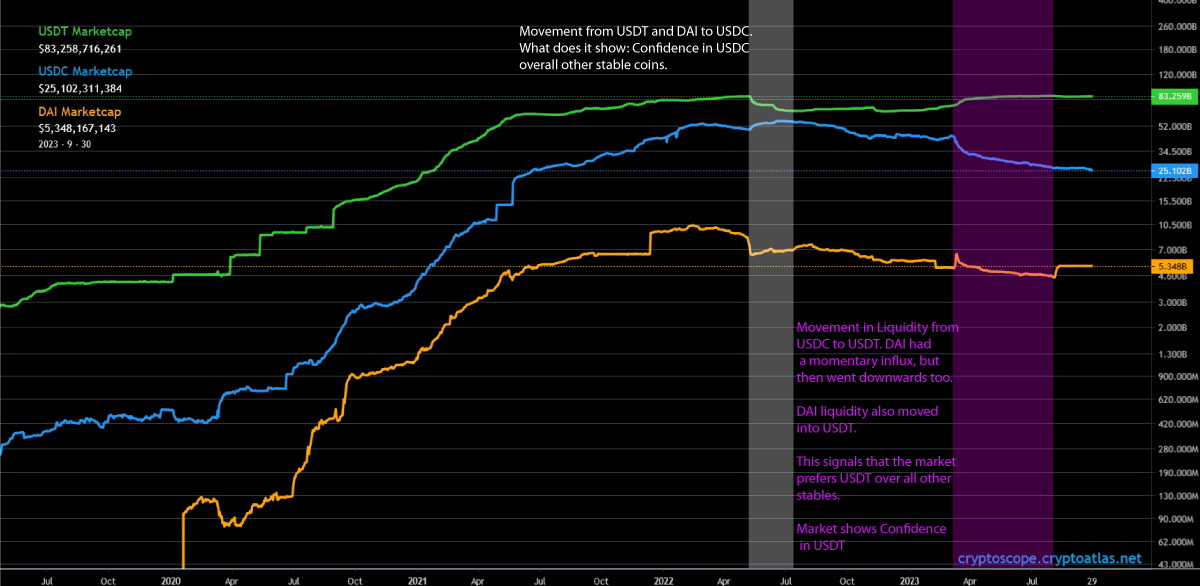

In the chart below, we can see periods where the market as a whole moved from one stable coin to another. This illustrates a preference for one stable coin over the rest. It also shows that the market is confident in that one particular stable coin.

For example, a large percentage was moved from USDC to USDT. The marketcap of USDT increased, while the marketcap of USDC decreased. Since each is pegged to 1USD, the supply effectively moved.

In the chart above, it illustrates how liquidity moved firstly from DAI and USDT to USDC. Combining this knowledge with other charts, we would know that this was in the final stages of the bear run. Also, it was in June-July of 2022, when Terra Luna lost billions and ultimately collapsed.

Then after, more recently, retail investors have been flocking from USDC and DAI and into USDT. This was mainly due to the March 2023 banking crisis. In this time, some banking partners that Circle, USDCs used to store the collagenized USD were going bankrupt.

To hedge their risk, traders began dumping USDC for USDT and DAI. USDC also lost its peg at one point, though it regained it after the banking crisis was resolved.

A conclusion can be made from this analysis. That crypto enthusiasts and retail traders still don’t have confidence in USDC, and that DAI has recently had a surge in marketcap, illustrating a possible trend reversal.