Traders' Perspective: Why Stable Coin Dominance Matters

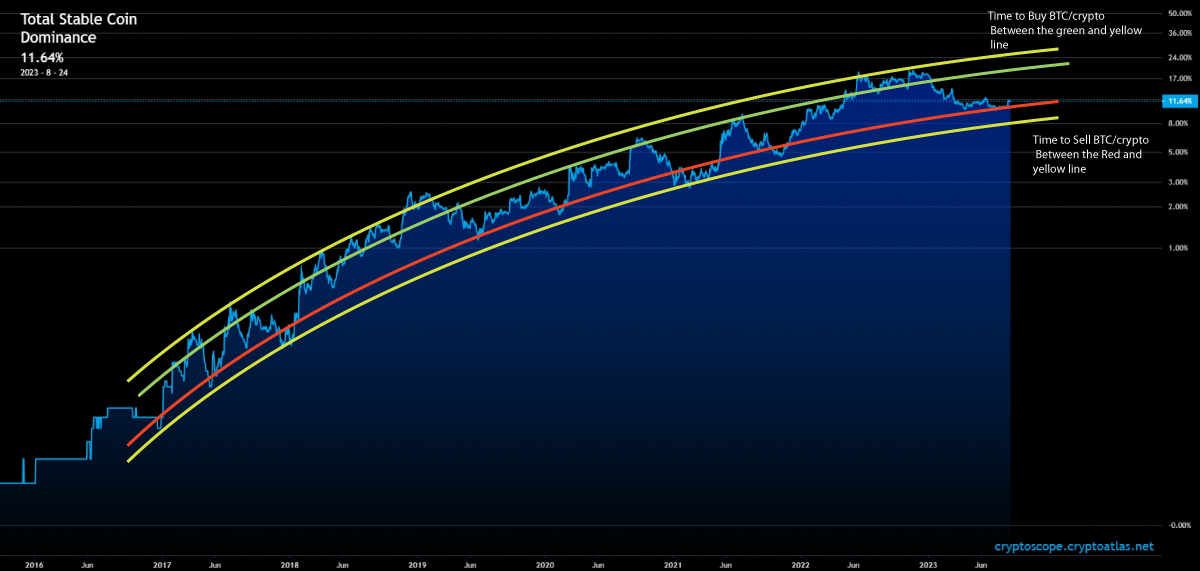

Stable coin dominance influences the broader cryptocurrency to a great degree. To understand this we can look at the stable coin dominance chart.

The stablecoin dominance , like most metric type charts, tends to follow rules to technical analysis such as support and resistance.

Using the support and resistance, we can predict in which direction the total stable coin dominance is headed. The total stablecoin dominance has an inverse effect with the broader cryptocurrency market composed of Bitcoin and altcoins.

When the total stablecoin dominance goes up, we can predict that the cryptocurrency market is going to go down, and vice versa. A total stable coin dominance going down indicates that BTC and altcoins are going up.

In the Image below we can see different support and resistance zones within the stable coin dominance chart.

As you can see, the total stable coin dominance is about to hit resistance. We can predict that there is a likelihood that the stable coin dominance will get rejected here. There is a great probability that it will, but like all TA, it is not with 100% confidence. The probability here is probably 70% rejection, 30% breakout.