Strategies to Trade Based on The Altcoin Dominance

Support and Resistance Indicators Using the Altcoin Dominance Metric

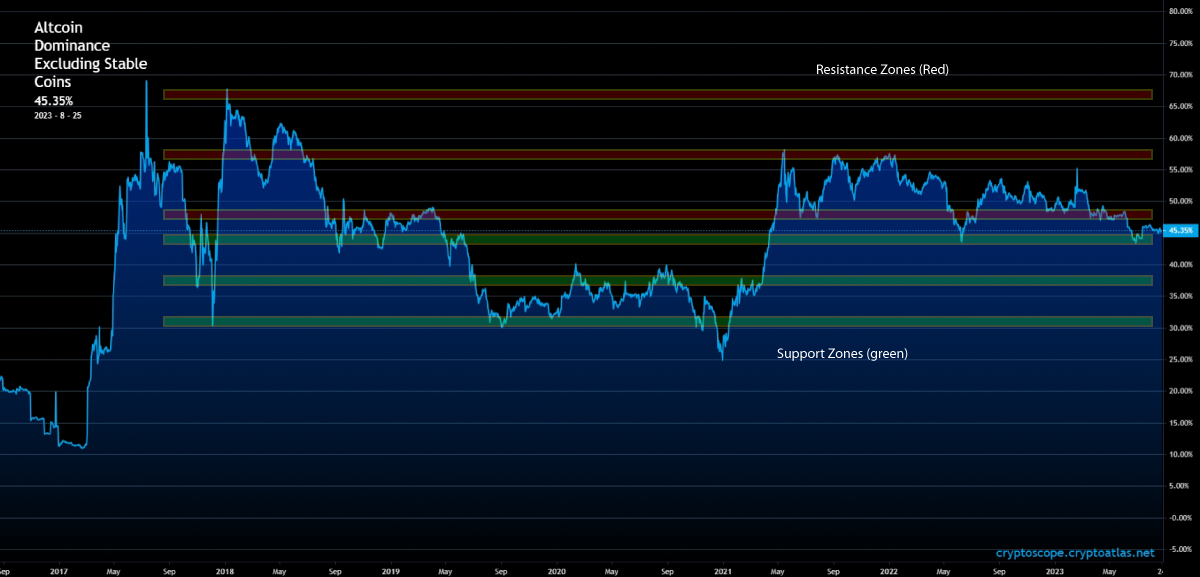

The altcoin dominance chart can be used to gather powerful altcoin market insights. We can learn about zones where the altcoin market has weakness. We can learn about zones in which it may not be a great idea to enter the market. One of the best forms of technical analysis is support and resistance.

Support and resistance zones offer traders insights on the likelihood of the direction in which the altcoin market is headed towards.

When the altcoin dominance is at a significant resistance zone, the likelihood of the altcoin market getting “rejected” and going back lower Is high. Using the resistance zone as an indicator can become a powerful tool.

When the altcoin dominance is at a significant support zone, the probability that the altcoin market is going to “bounce” and tread back up higher is high. This can become a great indicator to use when assessing when to get into the markets.

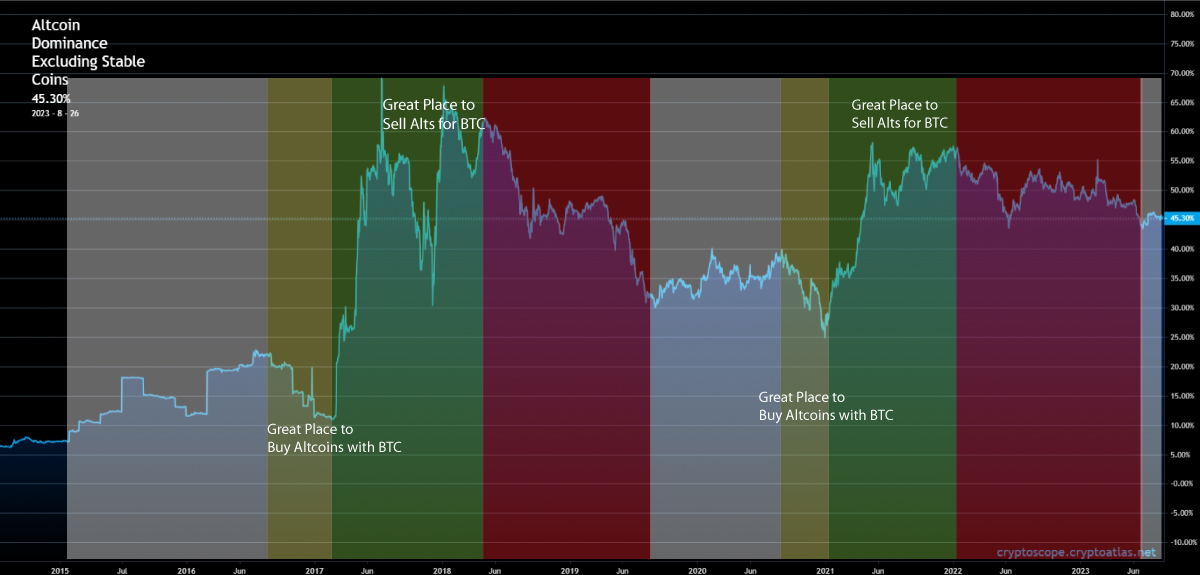

Bitcoin Farming With Altcoin

The altcoin dominance can be used to farm Bitcoin. Here is how, but first there is one caveat to understand. There is a difference between crypto and bitcoin. There will only ever be 21 Million Bitcoins. People can create an infinite number of altcoins. Thus, this strategy is based on the intent to acquire more Bitcoin.

There are two factors that allow traders to farm Bitcoin. The First one is that Altcoins are speculative in nature and often outperform Bitcoin in the cycle. New altcoins are created every year. Secondly, like the Bitcoin Dominance, the Altcoin dominance is cyclical. These two factors allow traders to buy altcoins at the bottom of the cycle and sell them for Bitcoin at the top of the cycle, rinse, and repeat.

Let’s take a look at the altcoin dominance to see how it is cyclical and how different phases of the cycle can help traders farm Bitcoin using altcoins.

The strategy here is to cycle in and out of altcoins with the attempt to increase your BTC position. This strategy never touches fiat currencies or stable coins.