Investors' Angle: Gauging Market Health with The BTC and ETH Dominance

The Bitcoin and Ethereum Dominance metric can together be used to gauge the market health.

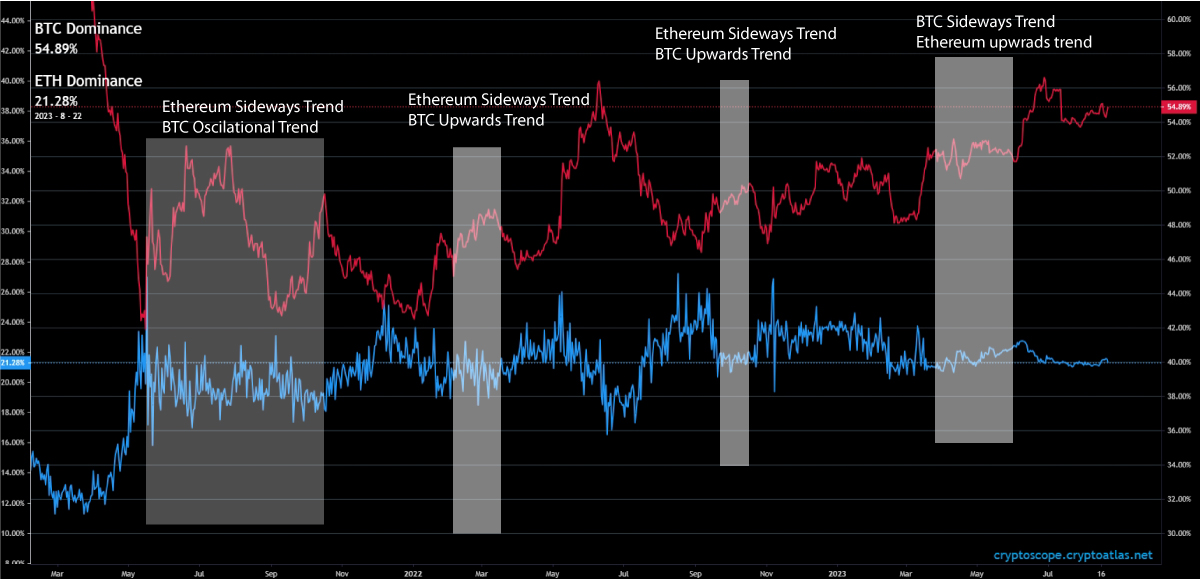

The Bitcoin Dominance and Ethereum dominance are usually synchronous with each other in an inverted manner. When the Bitcoin dominance goes up, usually the Ethereum dominance goes down. Vice versus can be possible to.

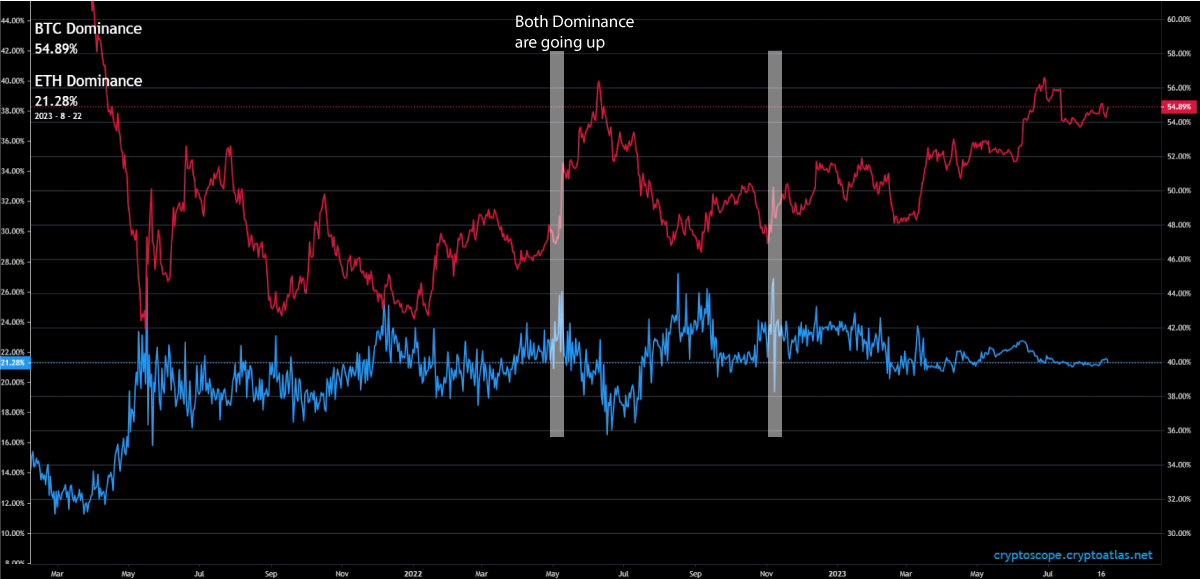

There are moments though, when they both go up together, though these moments do not live very long. When this happens Bitcoin and Ethereum both take out dominance from the rest of the cryptocurrencies such as BNB, Litecoin and Solana. These moments are rare.

In other occurrences, what also tends to happen is that the Bitcoin Dominance goes sideways, but Ethereum dominance falls or goes up.

Typically, this means that Bitcoin and the rest of the market are either outperforming Ethereum or underperforming it. Holding anything but Ethereum or only Ethereum can be critical in these moments.

We can gauge which sectors of the market are great using the bitcoin dominance vs Ethereum dominance chart. This chart can be seen as the entire crypto market divided into 3 parts: BTC, Ethereum and the rest of the crypto market.

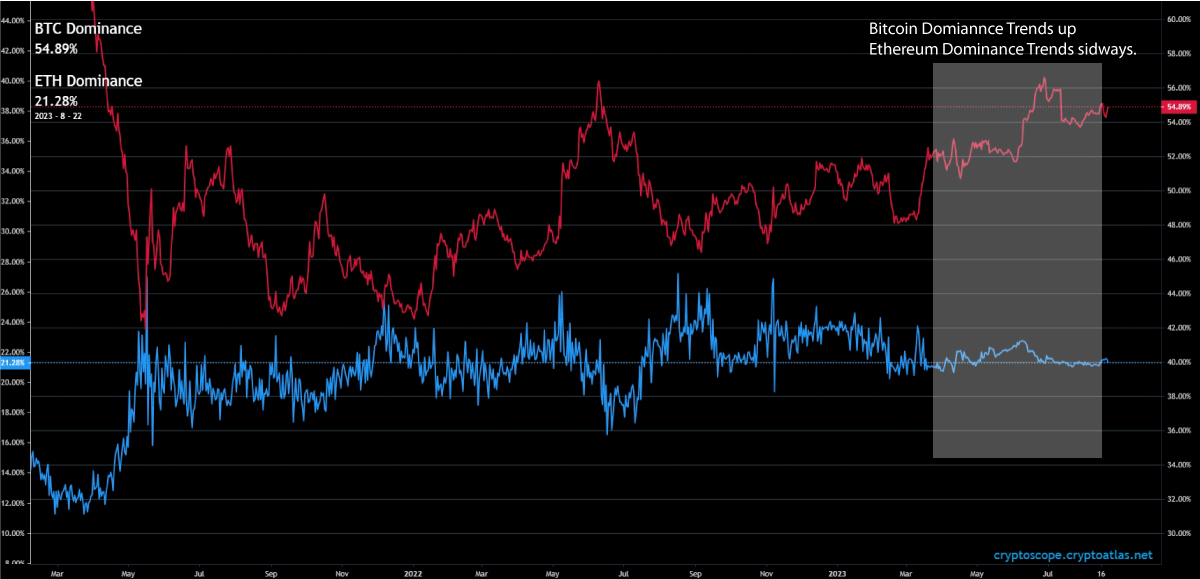

Let's take a recent example. When the Bitcoin dominance goes up, and the Ethereum dominance stays the same, what conclusions can we draw about the current market? Firstly, retail speculators are not interested in Ethereum but rather Bitcoin. They are not willing to speculate on far more risky assets.

Secondly, the altcoin market excluding Ethereum is currently not drawing attention from crypto enthusiasts. If the Bitcoin dominance goes up and the Ethereum dominance stays the same, it can mean one thing: the altcoin dominance excluding Ethereum, is going down.