Trading Strategies: Leveraging Insights from the Altcoin Marketcap Excluding Ethereum and Stable Coins

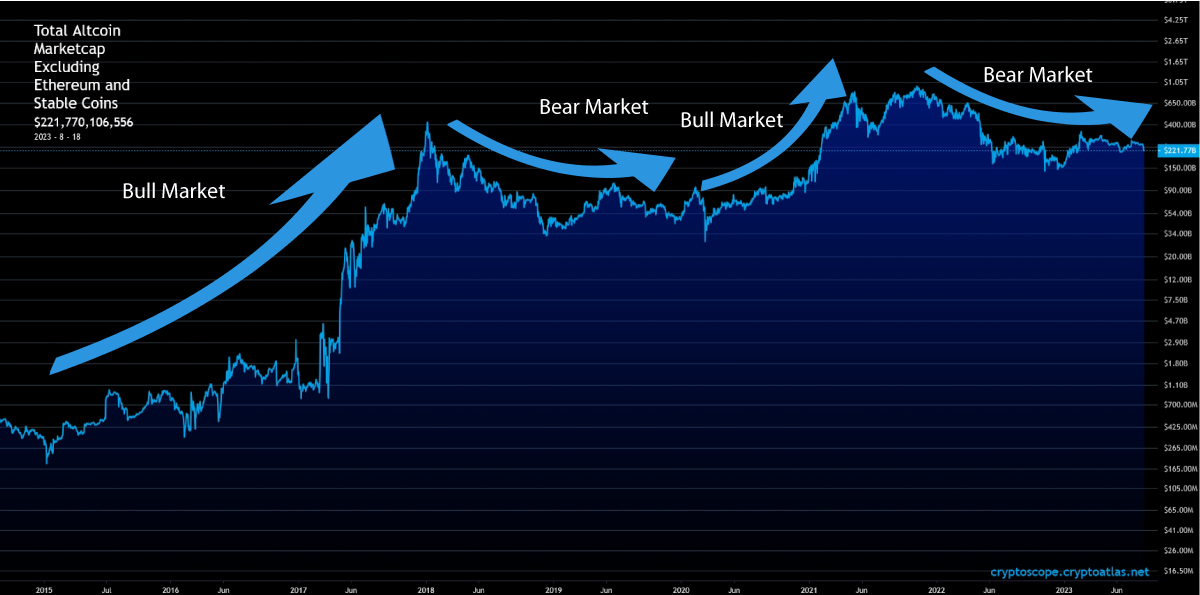

Technical analysis can be performed on the altcoin marketcap excluding Ethereum chart. We can use classical analysis such as support and resistance and trend analysis to predict where the altcoins are headed using their combined marketcap metric.

Classical TA on the Altcoin Marketcap Excluding Stable coins and Ethereum.

The combined marketcap of all altcoins excluding Ethereum follows support and resistance. When there is a level of significant resistance, the combined market will probably get rejected. When there is a support zone, the combined altcoin market will bounce off of the zone.

We can use these zones as an indicator to predict where the altcoin market is headed.

In the image below, we show various support and resistance zones. In the future these zones may have a significant effect on the direction and movement of the combined altcoin market excluding Ethereum.

The Trend is your Friend Until the End: Altcoin Marketcap Metric

Using the altcoin marketcap chart excluding Ethereum we can get insights on the current market trend. We know from classical technical analysis that it is not wise to go against the trend. Selling on a bull market may backfire and buying in a bear market may lose you money.

Accurately understanding the current altcoin market trend, whether bullish or bearish may save crypto enthusiasts thousands of dollars.