Strategies for Traders: Leveraging The BNB Dominance Charts

Classical Technical Analysis and The Binance Coin(BNB) Dominance Excluding Stable Coins Chart

Classical technical analysis such as support and resistance lines can prove to be a valuable indicator to retail traders, investors and speculators. The Binance Coin Dominance chart respects support and resistance lines to a great degree.

Much like traditional assets or even price charts of popular cryptocurrencies, the Binance Dominance can get rejected or bounce off of support and resistance zones.

In the chart below we can see some support and resistance zones within the Binance coin Dominance excluding stable coins chart.

Trend Analysis using the Binance Coin (BNB) Dominance Chart

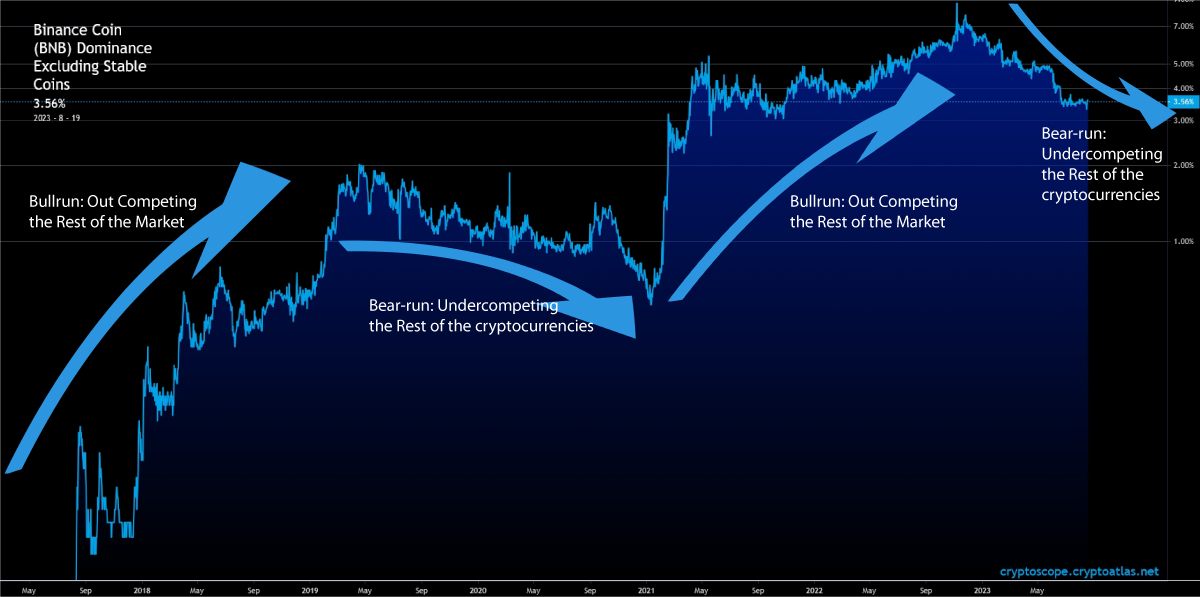

The Binance Coin Dominance chart can also be used as an indicator to get a perspective of how the Binance Coin is competing against the rest of the cryptocurrency market.

A Bull rally within the Binance coin dominance chart indicates that Binance Coin is outcompeting all other assets in the crypto-space. When this trend is finished, it is a great indicator which shows analysts that the broader market may be outperforming Binance coin.

At this point holding Binance Coin as opposed to other cryptocurrencies makes less sense.

When the Binance Coin Dominance chart is in a bull or bear trend, it doesn’t necessarily mean that Binance coin is going up or down in USD value, but rather how it is performing relative to the rest of the cryptocurrencies.

They say the trend is your friend until the end. Buying Binance Coin when the BNB dominance chart is in a bear trend may not make you lose money, but your cryptocurrency portfolio certainly won’t outperform other coins such as BTC or Ethereum.

It can also be vice versa too, buying BNB Coin within a bear trend of the Dominance chart may result in both USD losses and in being outperformed by the rest of the cryptocurrency market.

In the illustration below we illustrate bull and bear trends of the Binance Coin Dominance Excluding Stable Coins Chart.