Strategies Derived from Cardano's Dominance: Tips for Traders

Classical Technical Analysis with the Cardano Dominance Chart

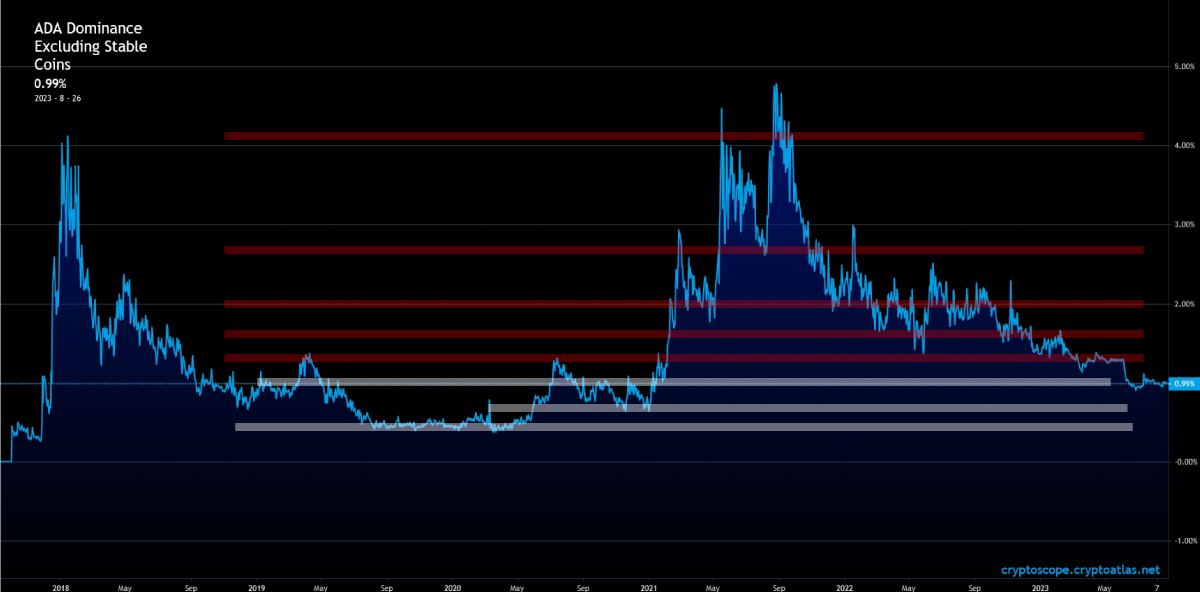

The Cardano Dominance excluding stable coins chart can be used as an indicator for traders who want to make more money. The Cardano Dominance metric seems to follow basic rules of technical analysis such as support and resistance.

There are support and resistance zones within the dominance chart. The probability of the dominance getting rejected or bouncing from these zones increases when the Cardano dominance is at these zones.

Traders can place bets or make more informed decisions based on where the Cardano dominance is, relative to these support and resistance zones.

Take for example a scenario in which the dominance is at 4% and the zone above it is a significant resistance zone. It would make sense to come to the conclusion that the probability of the dominance getting rejected from this level is high.

We can draw a conclusion to this analysis. This is that since it has a high probability of getting rejected, the rest of the market may outcompete Cardano with respect to gaining or retaining value.

In the image below we can see a few support and resistance zones within the Cardano Dominance Excluding Stable Coins Chart.

Market Cycles within the Cardano Dominance Chart

There are certain points in time where holding Cardano is better than holding any other altcoin within the crypto market.

The dominance is a cyclical metric. There are moments when holding Cardano is a terrible idea, and a great idea. During bull runs, people take more risk by obtaining very speculative assets. It is at this time when it is better to swap ADA for BTC or stables.

It should be noted that this is the dominance. Cardano can outperform all other assets and still go down in price. Cardano can also go down in price and underperform other assets. In this scenario, the dominance goes down and the price of Cardano goes down as well.

Cardano can go up in price, and down in dominance. This means that the overall market(BTC and other coins) makes more gains compared to Cardano.

In the image below we have some zones where there is too much risk in holding Cardano. There is also a zone where attaining Cardano can make your portfolio outcompete other assets.