Speculators' Guide: Predicting Market Movements with The Ethereum Dominance Excluding Stable Coins Chart

Support and Resistance Analysis on the Ethereum Dominance Excluding Stable Coins Chart

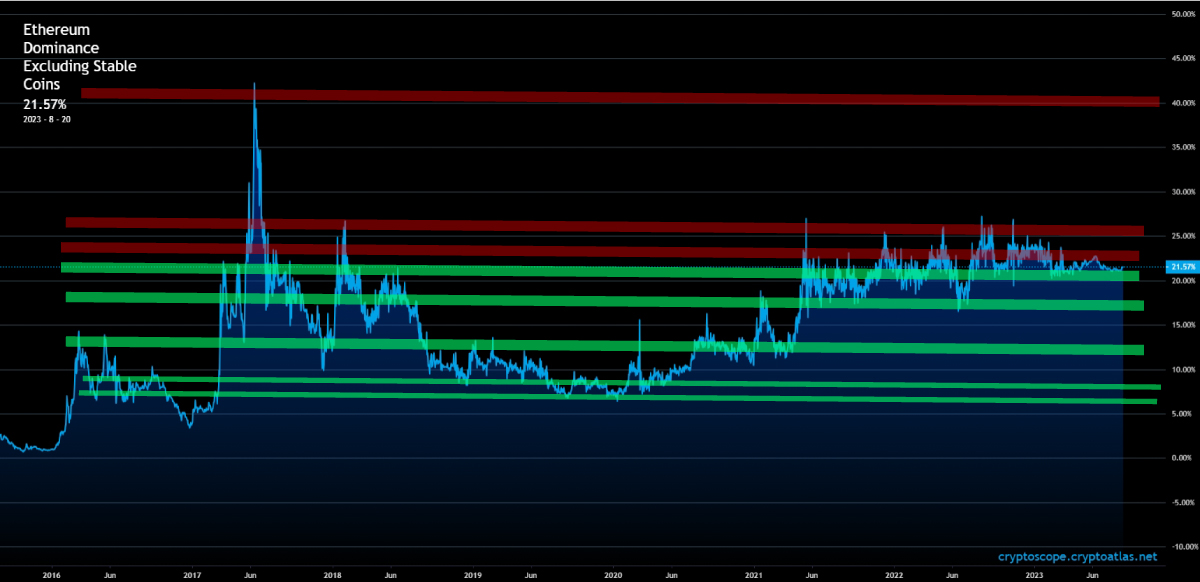

The Ethereum dominance chart supports the rules of classical technical analysis, support, and resistance.

There are certain support and resistance zones within the chart that, when the Ethereum Dominance reaches them, increases the likelihood of the metric bouncing or getting rejected from that zone.

This can be used to predict where the Ethereum dominance is likely headed. Of course, nothing is certain.

The Ethereum dominance bounces and gets rejected from various support and resistance zones in historical times. We can see the general support and resistance zones in the Ethereum dominance chart below.

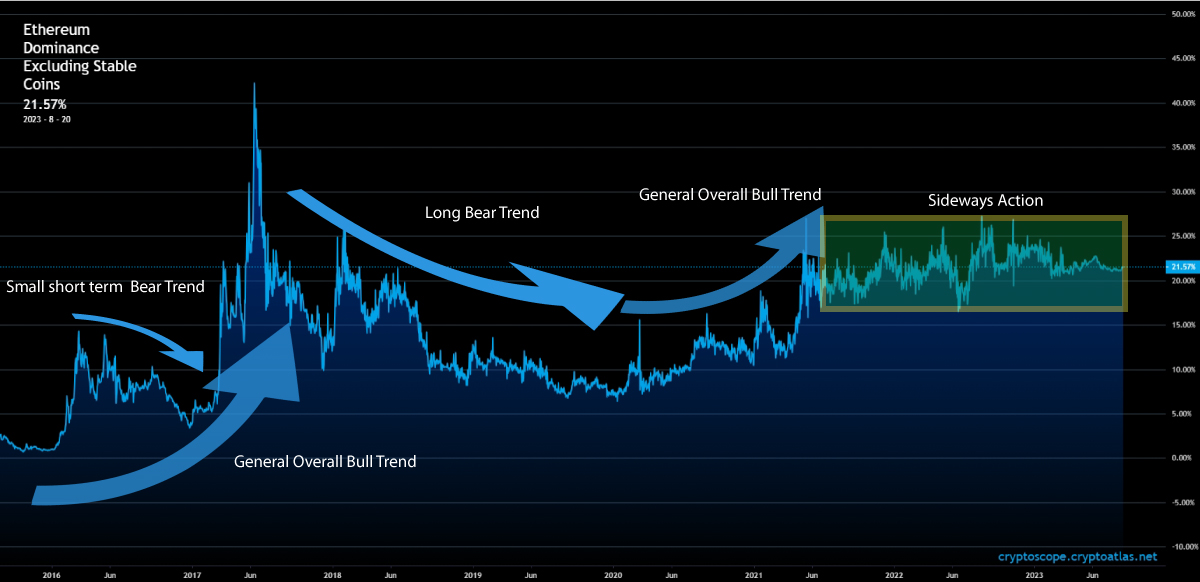

Macro Trend Analysis with the Ethereum Dominance Chart

There is a saying that says: “The Trend is your friend until the end.” The Ethereum Dominance chart can be used to get insights into the current trend in which the Ethereum Dominance is in. Like with ordinary priced assets, the Ethereum Dominance has its own trends.

A bear trend within the Ethereum dominance excluding stable coins chart illustrates that most other crypto assets or Bitcoin are outcompeting Ethereum. In other words, Bitcoin or other crypto assets are retaining or attaining value much better than Ethereum.

A bull trend indicates that Ethereum is retaining its value or appreciating faster than other crypto assets such as BTC and BNB.

Holding Ethereum when the Ethereum dominance chart is in a bear trend means two things for crypto asset holders.

Firstly, that other large assets are appreciating with regards to dollars at a much faster rate, or that Ethereum is losing value in higher degrees than similar crypto assets such as BNB and Bitcoin. Holding Ethereum when Ethereum is losing value quicker than other crypto assets indicates that the asset holder has more risk holding Ethereum than other crypto assets, and they may need to reposition themselves.

In the image below we can see how the Ethereum Dominance excluding stable coins chart can be used to figure out the trend.